While doing your financial planning, a term insurance plan is an important addition to your financial portfolio. With a low premium rate, term insurance plans allow you to ensure your family’s financial security in your absence. However, at the time of purchasing a best term insurance policy, most people often ignore the most critical factor- the selection of the mode of premium payment.

There are two ways to pay a term policy premium- limited and regular. In a limited pay plan, the policyholder is liable to pay the premium for a specific time period to get full coverage for the entire policy term. Whereas, in a regular pay plan, the policyholder needs to pay the premium for the entire length of the policy to enjoy the coverage.

Now the next obvious question is- which one to go for?

If you are looking to invest in a term plan without destroying your wallet, then the limited pay option is the best choice for you. Along with the coverage benefits, the limited pay option reduces the financial burden of paying premiums for a longer period.

For example- if you buy term insurance with a limited pay option of 40 years (policy term) and a premium payment term of 10 years, then you’ll get coverage for 40 years without paying a single penny for the last 30 years.

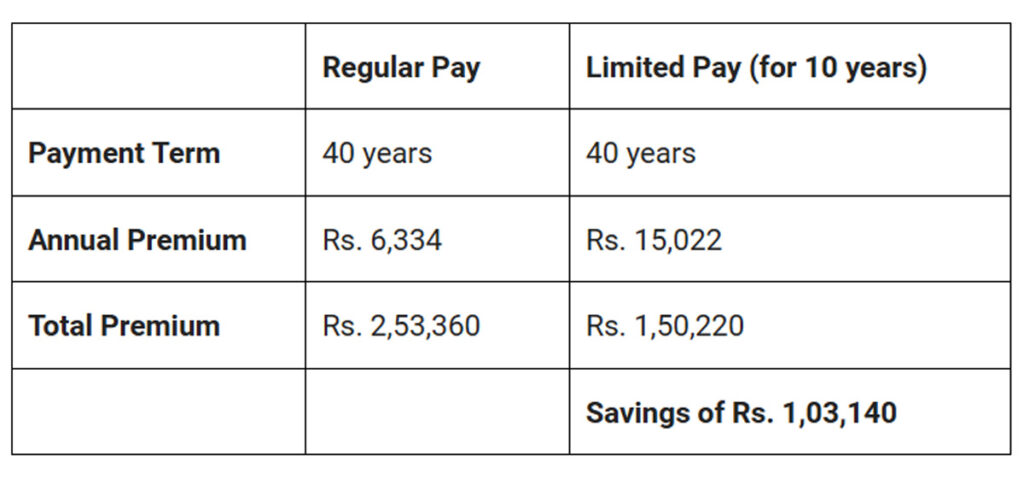

Below is the simple illustration of limited pay plans vs regular pay plans.

Sample comparison for Rs.50 lakhs term cover and 40 years coverage for a 30-year old Ravi (non-smoker).

If Ravi opts for a regular pay, then the annual premium comes out to be Rs. 6,334. For 40 years, he will pay Rs. 2,53,360 (6,33440). If Ravi chooses a limited pay option, then the annual premium comes out to be Rs.15,022. For 10 years, he will pay Rs. 1,50,220 (15,02210).

Ravi’s total savings under the limited pay option will be- Rs. 1,03,140 (2,53,360-1,50,220).

Read along to explore more advantages of choosing a limited pay option:

Low Chances of Policy Lapse

With premiums payable for a limited period, one doesn’t need to make efforts to pay premiums on time for a longer period. For example, if you choose to pay a premium for a limited period of 10 years and once all premiums are paid, you can enjoy uninterrupted coverage till the end of your policy tenure, without the risk of policy lapse.

Longer Coverage Duration

With a limited pay option, you can choose term plans that offer longer coverage durations. While you pay for a short period, you can continue to get coverage even after your retirement.

Suitable for individuals with a short career span

Some individuals have a short career span or often face fluctuating monetary situations. For such individuals, limited pay is an option that frees them from long-time premium payment obligations.

Tax Benefits

Since limited pay term plans tend to have a higher premium than regular term insurance plans, you get a maximum deduction and can claim tax benefits under Section 80C of the Income Tax Act, 1961.

To sum it up…

Both limited pay and regular pay come with their pros and cons. One should choose the payment term as per his/her monetary condition and requirements.

Press release by: Indian Clicks, LLC

Tags Low Premium Insurance PolicyX PolicyX Term Insurance

Gulte Movie News And Politics

Gulte Movie News And Politics